The Mystification revolving around Bitcoin Price simplified

Bitcoin needs no formal introduction these days. The world at large apprehends this virtual currency irrespective of their age and profession. So, saving some lines in this post by not explaining what bitcoin is!

Just at the moment, you are in the know about bitcoin, the very next thing that hits your mind is “Bitcoin Price”. It has always been a matter of concern for investors. A price that touches almost $20k mark from zero and then down to $3k surely intrigues the populace.

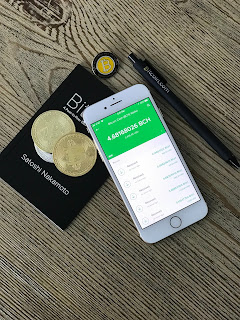

Source: Photo by Dmitry Moraine on Unsplash

Bitcoin and other cryptocurrencies were at the center point of attraction in December 2017. This is because the ones who had bought bitcoin at lower prices turned into millionaires overnight! We can mark this particular time period as a milestone in the history of bitcoin. So, obviously, this price hike made people attentive towards bitcoin (even those who were not aware of it!).

Then came a mass buying phase which dropped the price of bitcoin to an all-time low and has still not recovered. Predictions of the bitcoin price reaching $50k and $1M were still being made by the optimists. However, the feeling of confusion and anxiety also surrounded the populace.

These occurrences in the price history of bitcoin mystify the people and thus either refrain them from buying or selling the virtual currency. Hence, leaving you in the dark about what would happen to the bitcoin price the next second.

Source: Photo by David Shares on Unsplash

So, here I bring forward some common questions (and their answers) regarding bitcoin price. Hope it will help you decide.

What determines the price of Bitcoin?

Initially, when the term was coined back in 2009, its value was almost negligible. We can say like $0. Thereafter, NewLibertyStandard which is a bitcoin exchange site recorded the transaction of 5050 bitcoins for $5.02. This transaction elicits that the value of bitcoin is a little over zero.

But how was this rate determined?

The exchange itself had determined this rate by approximately calculating the cost of electricity required to generate the coin. Then in 2010, two Papa John's pizza worth $40 was bought by paying 10,000 bitcoins. This is said to be the first real-world transaction and still, the value of one bitcoin is close to zero.

The bitcoin price instigated to surge when the demand increased. It touched $1 in 2011 and subsequently; the graph witnessed radical ups and downs. Hence, it is not rocket science. The determination of bitcoin price is merely based on supply and demand.

Which factor is responsible for the frequently fluctuating price of Bitcoin?

If you have registered on an exchange, you might have noticed that the price is changed almost every second. As mentioned earlier, the price is based on the supply and demand model because of which the seller might demand a certain price and the buyer is willing to pay a certain price. When both of them agree on a common price, a trade is made. Such trades fluctuate the bitcoin price frequently.

Is the price of Bitcoin geographically different?

Technically, yes. Minor variations prevail because of different currencies and market inefficiencies. Moreover, the bitcoin trade is finalized at varied rates and thus adds up to the change in value.

What are the bid and ask prices?

If you have traded in the stock market, then the concept of a bid and ask price is pretty much the same in case of bitcoin. The buyer specifies a price at which he/she is willing to buy bitcoin and is called bid price. The seller offers a price at which he/she is willing to sell bitcoin and is called ask price. A successful trade is the consequence of the overlapping of the bid and ask prices.

How does the buying and selling of Bitcoin work?

So, you have registered on an exchange, got yourself verified and ready to make a trade. You place the bid or look for a favorable ask price to buy bitcoins. Once found, you make the trade. So, this is it? What goes on in the background? And most important, who generates bitcoin and tracks the transfer between different accounts?

The one single answer to all these questions is “Blockchain”. As some of you may know, the concept of blockchain technology was introduced to the world along with bitcoin. It is a decentralized public ledger that records all the transactions using SHA-256 (a type of cryptographic algorithm). It records the public address of the buyer, seller and the number of bitcoins transferred between them.

There are specialized programmers who solve the puzzles using SHA-256 to conclude the transaction. To perform this task, they are rewarded with bitcoins and this is how they are generated. This is just a basic overview, for the detailed functioning of blockchain, kindly visit this post: Blockchain is not what you think (And what it really is!)

Over to You!

That's all folks! Hope your dilemma is solved. Got any further questions? Then add in the comment. I'll try my best to help!

This option is perfect for those that are interested in making a profit by buying a large number of btc shares in a short amount of time. This is another great way to make money and purchase btc at the same time. Get detailed info about buy bitcoin on this web.

ReplyDelete